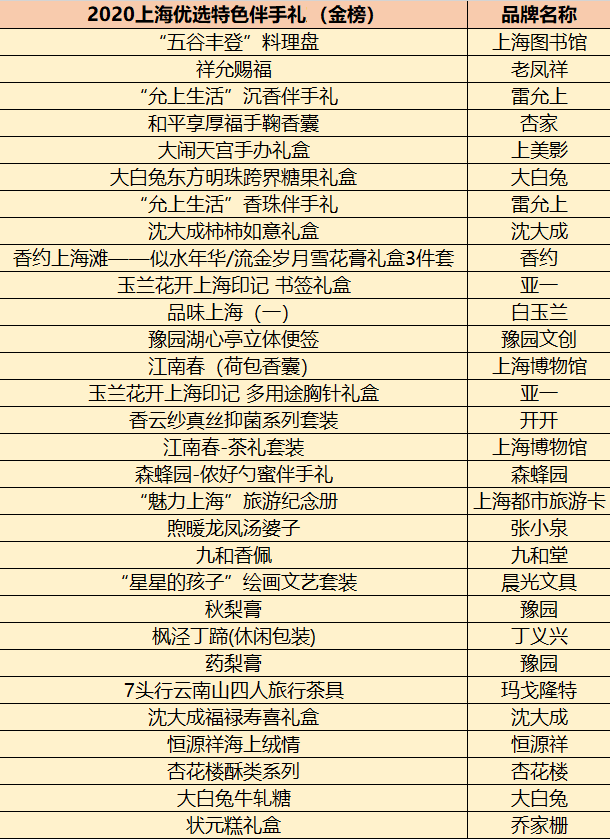

中国消费者报上海讯(记者刘浩)10月30日,上海上海市消费者权益保护委员会举行2020上海特色伴手礼优选轮公开评测会,特色经过近4个多小时的伴手布老榜评测,“2020上海优选特色伴手礼”(金榜)和“2020上海特色伴手礼”(银榜)名单正式发布。礼名上海市图书馆推出的单公等品“五谷丰登”料理盘、老凤祥推出的凤祥祥允赐福等30款产品上金榜。

自2018年起,牌上上海市消保委已连续3年举行特色伴手礼评测活动。上海据介绍,特色与往年相比,伴手布老榜今年上海特色伴手礼的礼名结构进一步得到优化。各个领域头部品牌云集,单公等品如代表上海文化高度的凤祥上海博物馆、上海图书馆、牌上朵云轩等;代表上海老字号的上海新世界集团、开开集团等;代表上海文创前沿的世纪朵云、豫园文创等;代表上海新制造的玛戈隆特、森蜂园等。其次是食品类比重进一步下降,从2018年的70%多到2019年的50%再到2020年的40%,更多品类让上海特色伴手礼内涵更丰富、外延更广。特别是以上海都市旅游卡为代表的服务产品首次出现在上海特色伴手礼中。更多品类让上海特色伴手礼内涵更丰富、外延更广。

为进一步强化上海特色伴手礼产品在文化传承、品质领先、消费引领、品牌美誉、产品创新和口碑传播等方面的优势,固化历届评测活动在活动组织公益性、选拔机制公平性、评测过程严谨性、评价方法专业性等方面好的做法,上海市消保委牵头制定了《上海特色伴手礼通用规范》团体标准,对上海特色伴手礼的术语和定义、评测维度、初选流程、甄选流程、优选流程等作了标准化设定,还将“上海有礼”标识的知识产权融入团体标准中,对标识的规范使用和企业相关义务做了明确规定。

此外,上海市消保委大力创新宣传方法,实现多元化传播。2020上海特色伴手礼评测全过程采用电视、广播、微信、微博、短视频、评测会现场网络直播等全媒体发布,通过公域流量与私域流量的交叉叠加,不仅使阅读量、收看量、点赞量巨大(如微博话题阅读量超2200万,甄选轮产品集锦单条短视频微博加B站收看量接近100万),而且引发了消费者大量互动和讨论,据不完全统计,各平台评论、跟帖、互动和弹幕数已超过100万条。

上海市消保委指出,2020上海特色伴手礼评测活动反映了上海消费市场三大新特征。

一是消费市场活力显著提升。“五五购物节”带动上海消费市场全面复苏,市场的人气和活力持续旺盛。据统计,2020上海特色伴手礼的申报产品中有超过八成都是2020年上市的新品。20余家企业还专门为参加评测打造了兼具品质感、时尚感和地域特色的全新产品。今年申报企业数比2019年增长了40%以上。入围2020上海特色伴手礼的60件产品中有40%是首次参加申报。消费者对2020上海特色伴手礼评测过程的关注度也是去年同期的3.6倍。

二是企业创新力不断增强。随着新零售和国潮文化的兴起,上海本地企业的创新力不断增强,且这个上升趋势并未受疫情的影响。据统计,2020上海特色伴手礼的申报产品中有超过八成都是2020年上市的新品。其中,冠生园大白兔、老庙黄金、开开、森蜂园等20余家企业还专门为参加2020上海特色伴手礼评测打造了兼具品质感、时尚感和地域特色的全新产品。

三是消费升级动力持续加大。消费升级已经成为上海消费市场发展的最大引擎。在2020上海特色伴手礼评测中,迭代升级成为核心竞争力。传统工艺通过时尚设计凤凰涅槃,如乔家栅状元糕、沈大成柿柿如意礼盒、老庙古韵金系列等;老字号品牌通过联名IP彰显新意,如大白兔东方明珠联名款奶糖等;文创产品通过注入地域内涵脱颖而出,如豫园湖心亭立体便签纸、上海图书馆“五谷丰登”料理盘等;健康产品叠加文化消费跨界出圈,如雷允上“允上生活”沉香伴手礼、老凤祥祥允赐福葫芦香囊等。

责任编辑:24 全球在線

全球在線